I started the company by finding a UK company that does all necessary steps for you. Then I found an accounting company to run the papers for me and that is what you need at the beginning.

Contents [hide]

Why I Started UK LTD Company as a Non-Resident

When I bought a membership website I needed to accept payments through Stripe and Paypal.

Paypal was not an issue because I had one already and it worked just fine.

But the issue was with Stripe which is still not available in my country. So I needed to find another solution and the only one that was the best choice is to open a company outside of my country.

Then I have read on forums that I can open a UK LTD company as a non-resident just in a day. I have contacted the person who was sharing his experience on the forum to speak about what are the steps to open a UK LTD company as a non-resident.

What I have found out is that I only need around 350 Euro and I will have company set in a day. After that I can open a Stripe business account in 15 minutes.

That sounded great because I could get all running in a day if everything runs smoothly.

I asked how he opened the UK LTD company in a day and he forwarded me to Quality Company Formations which I have contacted.

Open UK LTD Company as a Non-Resident

Open Quality Company Formation website and in their list of products select non-resident options. That will open a new window where you will start the process of opening a new company.

Here are the steps you will need to take in order to open a UK LTD company as a non-resident with Quality Company Formations.

Select Non-Residents Package

First you need to select on the Home page a product for Non-Residents so the system can take you to the right process.

When you select this package a new page will open.

Confirm Non-Residents Package

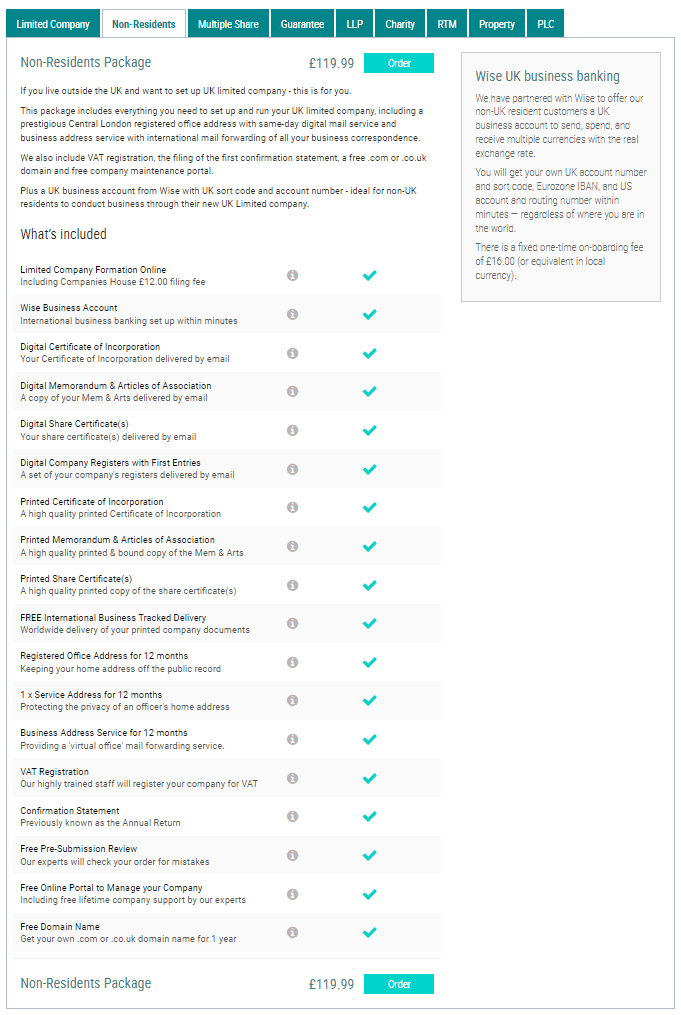

In this step you will need to overview what UK LTD company for non-resident packages contains.

It is a list of things you need to have because the quality company formations from their experience includes what is necessary.

The price is 119.99 GBP for the basic package you have for non-residents.

If you are ready you can go to the next step where you will have a choice to select more additional services if you want.

Select UK LTD Company Name

You need to selec the name of a company if it is available. Here you need to type the name and the system will check if it is available.

UK LTD Company Name Available

If the name you have selected is available then you will receive a message that confirms you are ready to go to the next step.

Click on the Save & Continue button.

UK LTD Non-resident Package – Additional Services

Here you have an option to select additional services.

When I was registering the company I used full company secretary service as additional service. I wanted that paperwork done properly without hassle.

It is paid annually so I think the service provided will help me to easily get through all obstacles in the UK as a non-resident.

UK LTD Company Registration Checkout

I have selected all what I think was needed and the total price is 321.98 GBP. It is a small price I have to pay to do all the paperwork.

But, also it is not a small price if you just start without any money.

I had some savings prepared for costs of running the business at the start so it was not so hard to pay for this.

But, these costs can pile up if you do not pay attention to what you are paying. If it is not needed 100% to move forward then use free service even if they are limited.

Pay for the UK LTD Company Registration

At the end you need to confirm and pay for the registration process.

After you fill the necessary data on this page you will be guided step by step to finish the non-resident company registration.

It will have several steps, but each step is easy and intuitive. It will not be something hard to understand.

If you need any help just call support and I am sure they will help you.

UK LTD Company Documents

When you register your company you will receive an email with all documents you need to have for your company.

That will include:

- Invoice you have paid

- Certificate of incorporation of a private limited company

- registers member certificates and minute book of Your company name

- Share class certificate that you own all share of your company

- memorandum and articles of association

These standard documents you receive, but they contain data you will need in the future whenever you use your company name.

For example for Stripe registration.

Find Good UK Accountancy for Non-resident Owner

When I opened a UK LTD company for non-resident I set up Stripe and the payment process on the membership site. Since then I had no issues with payments up to now.

But, now I have read more about running a UK LTD company for non-residents and I have seen that I as a director of the company have legal responsibilities.

That was something I was not aware of so I have started to read more about accounting and legal requirements as an owner of a UK LTD company.

What I have found is that I need to have an accountant who will help me with all the details running a company in the UK.

After three months running a membership company I have found a company that will help me with administration.

I have selected Accountancy CO in the UK because they had simple service and they were the cheapest.

Here are some details I needed to pay attention to and run some records.

Annual accounts

All trading companies have to file accounts each year.

Corporation tax

Within three months of starting to trade, but only once you have traded, you should register for corporation tax here – https://online.hmrc.gov.uk/registration/newbusiness/introduction.

First corporation tax payment is calculated at 19% of profit.

Record keeping

The government has a useful guide on the legal requirements – https://www.gov.uk/running-a-limited-company/company-and-accounting-records.

From a practical point of view, for new companies it will likely be possible to maintain records on simple spreadsheets – one for income and one for expenditure.

Note that if you have multiple sources of payment, it is good practice to have separate spreadsheets for each source.

Once a company’s trade increases in volume then bookkeeping software, such as Pandle is a good option.

Invoicing

There are legal requirements as to what needs to be included on your sales invoices and these are covered on the government pages, we also have a blog about it – https://www.hwca.com/accountants-london/creating-invoices-company/

Expenses

expenses must be ‘wholly, exclusively and necessarily’ incurred in the course of carrying out your company’s business activity.

This means that you should only claim an expense if it relates to your actual work so will include:

VAT

In addition, if the company exceeds the VAT threshold, currently £85,000, the company will have to register for VAT and file a VAT return every three months.

Whilst below the threshold, some companies opt to register voluntarily, the main benefit being that having a VAT number adds credibility to your business, it also enables the recovery of VAT on your costs.

The downside is that there is a significant increase in the administration and you may need to engage with an accountant if you are unfamiliar with the rules.

Banking

It can be very difficult to open a bank account for a newly incorporated business and whilst we are not able to assist with opening a bank account.

I have found Transferwise, Revolut and Tide to be good options when the High Street banks say no.

Information Commissioner Office Message

After three months I have received a message from Quality Company Formations that I have a new post.

Because I have an office open over there and they receive the post for me that comes to my registered address, they send me email whenever there is something for me.

So, I have received a message from ICO where they are asking me to fill the form and check do I need to pay the fee.

The best is to open the form and check which questions they have and do you need to pay that.

Here are the questions you can expect:

- Do you use CCTV for the purposes of crime prevention?

- Are you processing personal information?

- Do you process the information electronically?

- Is your organization responsible for deciding how the information is processed?

- Do you only process information for one of the following purposes?

- Are you a not-for-profit organization that qualifies for an exemption?

- Are you processing information for any of the following purposes?

At the end you probably will need to pay the fee as I have done.

UK LTD Company Accountancy Requirements

When you start using an accountant you will need to provide them with a personal Unique Tax Reference (UTR). That is a number you get from HMRC.

This is message I have received:

Please note that it is very important that we have your personal UTR in order for us to submit your self-assessment tax return, and to also authorise ourselves as your agents with HMRC.

Until we are authorised we are unable to check with HMRC if you have any outstanding returns which may need submitting. This may result in penalties being incurred.

But not only that one item. They need more things and here is the message I have received:

To make your life a little easier, we will outline all the information we need from you in this email, including the reference numbers we need to register your business for different accounting services and the authentication codes we need to allow us to correspond with HMRC on your behalf.

Details of previous accountant

If you had an accountant prior to joining us, please provide us with their details as soon as possible. Failure to do this can result in delays with your accounts and potentially even penalties. Until we receive this information, we will assume you do not have a previous accountant.

Self Assessment

If you are not registered for Self Assessment, then please complete the SA1 Form and email it back to us. All directors of UK companies must complete a Self Assessment each year.

Personal UTR

If you are already registered for Self Assessment, please send us your personal UTR number. This will be a 10 digit code and can be found on any correspondence from HMRC regarding your Self Assessment.

Previous year’s Self Assessments are not included in your monthly fee. If you would like us to compete them, the cost is £100 + VAT.

Company UTR

We will need to know your company UTR number to get authorised as your accountants with HMRC. This will be a 13 digit code ending in the letter ‘A’ and will be on any correspondence you have from HMRC regarding Corporation Tax. Please email this code to us as soon as possible.

Corporation Tax

You will also need to forward us your company’s authentication code. We have requested that Companies House to send it to you. Please email this to us as soon as possible.

Company Unique Taxpayer Reference (UTR)

Because I had no personal UTR I have forwarded them the company UTR which I have received over post. That same post item I have received over email scanned from the Quality Company Secretary.

Self-Assessment Form

But, additionally they needed from me to prepare what is needed for self-assessment.

This was their message:

Please find attached the SA1 form, this is the form used to register for self-assessment

Authorisation Code

After the accountant has requested the authorisation code I have received a new post item over email.

That email contained necessary data for the accountant.

The code started with CT and then numbers. Here is a screenshot of how it looks.

Authentication Code

After the accountant has requested the authentication code I have received a new post item over email.

That email contained necessary data for the accountant.

The code consist of letters. Here is a screenshot of how it looks.

Moving Forward

These were the steps I took to open a UK LTD company as a non-resident.

When I have hired an accountant I have spoken with them and I have received information that I need to enter all expenses and income into the Pandle so they can check if it is all ok or not.

Any other details I have not asked because at this moment all was too much to understand. So I decided to move step by step.

In the second part of this article I will put more information as I move forward. I hope it will help you in your blogging journey to become a blogger.

Recent Comments